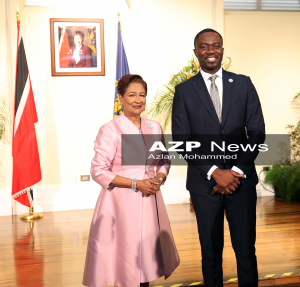

Professor Gerry Brooks

Professor Gerry Brooks

FORMER chairman of the National Gas Company Professor Gerry Brooks says that boards of directors should ensure that companies do not contribute to financial meltdowns.

He noted examples of Enron, Wells Fargo and even allegations of sexual misconduct at Fox News in the United States.

Brooks said, “The Caribbean (is) not to be left out. We have had incidents like CLICO which have cost the Caribbean $18 to $20 billion and which have wrecked lives at the most inopportune moments.”

He was speaking at the Aegis Business Solutions inaugural Caribbean Corporate Governance Conference at the Hyatt Regency in Port-of-Spain on Wednesday.

Brooks said great boards comprised members who were enablers, architects and futurists.

He said high performance boards should always bring in an outsider perspective, were strategic and innovative and hold management to industry benchmarks.

Brooks said boards should have a philosophy of disruptive competitiveness and gave the example of Netflix which created a new benchmark and shaped its own playing field from streaming to producing its own shows.

Delivering the feature address was Professor Charles Elson, the Director of Corporate Governance at the University of Deleware, who said a board of directors must not have any financial obligations to the management of the company.

Elson said while there should always be a diverse composition of board members, each director must be financially leiterate.

He said a director should only be on two or three boards to avoid conflict of interest and loyalty issues.

Elson said boards should have term and age limits for its members to create an avenue for new ideas.

He said the board members should be properly compensated, meet with shareholders and be constructive critics.

![]()