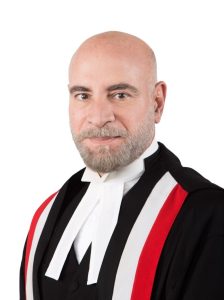

By Prior Beharry

COLLECTION of property taxes will begin in January 2024.

This was announced by Minister of Finance Colm Imbert during his presentation of the 2023/2024 Budget in Parliament on Monday.

He said, “In this context, I wish to advise that the collection of property taxes will be effective in the financial year 2024.

“Upon proclamation and operationalisation of the relevant sections of the local government legislation, residential taxes will be collected by the two cities, five boroughs and seven corporations to benefit our citizens within the 14 municipalities.

“We are at an advanced stage of operationalizing the property tax regime and bringing Trinidad and Tobago into the modern era.”

Imbert said the Valuation Division, with enhanced resources, has already crossed the 50% threshold of residential properties required to give effect to the population of the valuation roll.

He said, “Therefore, I am confirming today that in accordance with the law, I have received the residential property valuation roll for Trinidad and Tobago.

“This valuation roll will now be sent to the Inland Revenue Division, which will set in motion the procedural framework for collecting residential property taxes in the first instance.

“This will provide Local Government Bodies with a new and sustainable revenue stream to be used for procuring goods and services and/or their development programmes, and not for personnel expenditure. Legislative amendments will be made in due course to ensure that this money is not used for the wrong purpose.”

Imbert said since this is a new paradigm and the collection of property tax will take some time to ramp up, a new sub-item for the proceeds of property tax in the goods and services line item in the allocations for Municipal Corporations was created.

He said appropriate sums of money for each of the 14 municipal corporations, will be allocated, depending on their population size, ranging from $8 million to $12 million.

Imbert said, “These sums will be suitably increased during the mid-year review if the collection rate of property taxes exceeds expectations.”

He said the Valuation Division has established annual rental values for the national property portfolio comprising 600,000 properties as follows:

- 400,000 are residential;

- 49,000 are commercial;

- 3,000 are industrial; and

- 148,000 are agricultural.

Imbert said the next step was for the Board of Inland Revenue will calculate the property taxes based on annual rental values discounted by 10% with an application of 3 %percent of the discounted annual rental values,

For example, he said, with an annual rental value of $24,000, the property tax will be $54 per month being $24,000

minus $2400 which will equal $21,600 multiplied by 3 percent. This simple calculation will generate a tax of $648 per annum or $54 per month, the minister said.

Imbert said, “Based on the progress in the compilation of the valuation roll, I expect that at least 50% of all residential properties, and quite likely more than 50%, will pay property taxes somewhere between $540 and $1,080 annually.

“Moreover, for the lowest possible value which would be placed on a residence – $18,000 or less – the property tax will be approximately $41 per month. On the other hand, if someone owns a property which could rent for $3,000 a month or $36,000 per year, the property tax on that type of property will be $81 per month or $972 per annum.”

He said, “For more significant and larger properties that rent for $10,000 per month, the property tax would be $3,000 per annum or $250 per month, which is quite affordable for owners of properties in that higher range.”

![]()