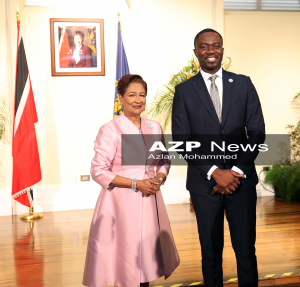

By Chantalé Fletcher

MINISTER of Finance Colm Imbert says that the Unit Trust Corporation of Trinidad and Tobago (UTC) has overcome its economic downturn caused by Covid-19 pandemic.

In a statement on Friday in the Lower House, Imbert highlighted some achievements in the report of the Auditor General on the Consolidated Financial Statements for UTC.

He said UTC showed a total income of $915.2 million when compared to a loss of $239.4 million in the previous year which resulted from favourable movements in the Fair Values of Investment Securities, which moved from an impairment of $1,032.7million ($1.03B) in 2022 to a surplus of $20.6 million in 2023.

Imbert highlighted the report showed an increase in investment by 14% from $776.5 million to $881.8 million due to improved dividend declarations and gains from increased interest.

Additionally, he said, “TT$ Income Fund generated the highest income of $438.2 million, followed by Growth & Income Fund of $184.4 million. Both funds showed growth by 8.0% and 7.6%, respectively. Interest income and dividend income increased by 15.2% and 5.3%, respectively.”

However, Imbert said the annual net income for 2023 was $57.7 million, an increase of 10.5% when compared to $52.2 million in 2022.

Imbert indicated this was a direct result of the positive movements in Net Change in Fair Value on Investment Securities as well as higher returns in Investment income.

“Consequently, a growth in retained earnings of 4.0%, from $1.6 million to $1.7 million was achieved.”

Meanwhile, Imbert stated total assets marginally increased by $32.6 million from $25,145.3Mn ($25.145B) in 2022 to $25,177.9million ($25.178B) in 2023 due mainly to improved cash inflows from the TT$ and US$ income funds.

He also stated UTC’s pension and post-retirement liabilities as at December 31, 2023 decreased by 60%, from $36.5million in 2022 to $22.8million in 2023.

Imbert said the pension plan for years 2022 and 2023 were in surplus as the fair value of P=plan exceeded the Present Value of Defined Benefit Obligation. And the funding ratio of the plan decreased from 104.0% to 103.8% in 2023 which is considered stable.

In terms of the Corporation’s regional development, he said two wholly-owned regional subsidiaries were incorporated in St Lucia the Corporation namely, UTC Fund Management Services STL Limited (FMS); and UTC Global Balanced Fund Limited (GBFL).

Imbert also stated the Corporation also entered into a 50/50 joint venture arrangement with GK Capital Management, the investment and advisory arm of GraceKennedy Limited (GK) to offer a suite of collective investment schemes in Jamaica, which contributed $0.3million in profits for the reporting period.

He added UTC has retained high ratings from rating agency the Caribbean Information and Credit Rating Services Limited (CariCRIS).

Additionally, they also achieved a CariAA Issuer/Corporate Credit Rating for Foreign and Local Currency on the regional rating scale and ttAA on the Trinidad and Tobago (T&T) national scale.

![]()