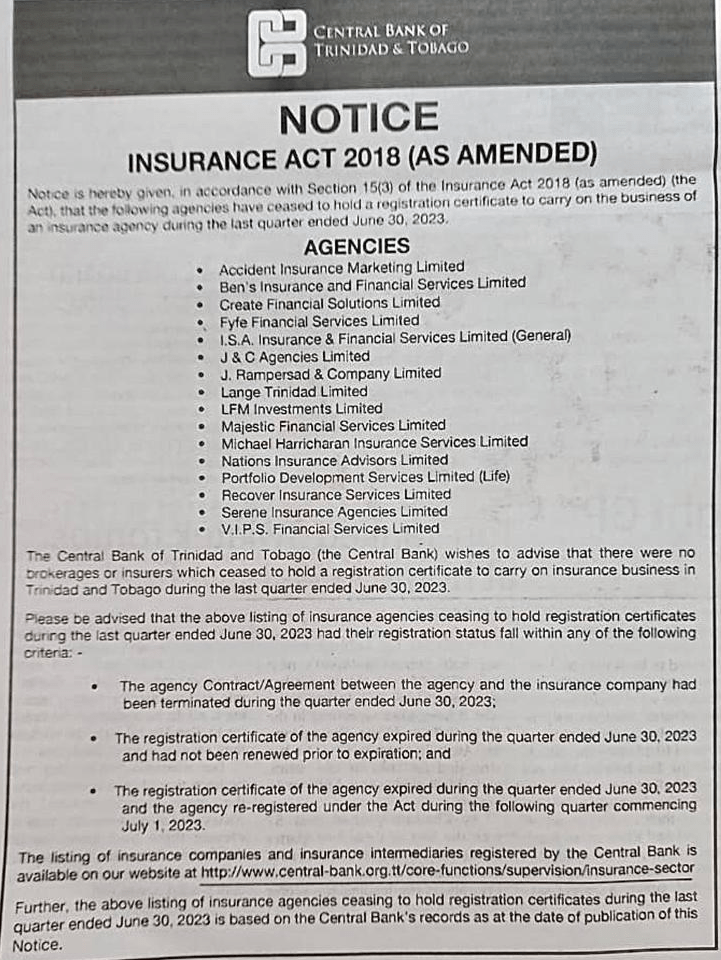

IN a recent publication in the daily newspapers it was revealed that 16 insurance agencies have ceased to hold registration certificates to carry on the business of an insurance agency during the last quarter ended June 30, 2023.

It is now clear that the Central Bank of Trinidad and Tobago (CBTT) together with the Association of Trinidad and Tobago Insurance Companies (ATTIC) have no issue with producers going out of the local insurance market and closing up shop.

The brokers and agencies are scared from the outlook of what they are seeing going on in the market, and they are scared to lose their families’ livelihoods. Sixteen is a lot in the last quarter!

Clearly CBTT must realise that this type of fall out is not good for business and taking away people’s livelihoods is going to affect their families ability to survive. This causes adverse effects throughout our industry and the CBTT as the regulatory body for insurers, agencies and brokers must stop hiding its head in the sand and address this situation directly.

Paid Political Ad

It’s coming down to the point where insurers will not need brokers or agencies anymore once they establish that link to directly deal with the brokers’ clients, they will no longer need nor respect the brokers thus eventually forcing them out of the market. It’s an untenable situation!

This seems to be the plan that many large insurers in the market are considering. Offering reduced rates to direct clients and additional discounts to capture their business directly.

One major insurance company recently advised their agencies and brokers that they have absorbed a substantial proportion of additional cost while only transferring a small element to our mutual customers by their increased premiums.

What a farce, as increased premiums have taken effect across the board by substantial amounts since last year. They advised that the effects of these costs have placed considerable pressure on their margins.

Mind you this is one of the largest insurance companies in the market and within the region that made huge profits previously and now after their review and evaluation of their profitability they have decided to look over their commission policy, with brokers and agencies.

Their decision was to reduce and or revise their normal commission structure effective August 1, 2023 to all brokers. Once one major insurer in ATTIC makes this move our experience is that other insurers follow suit.

It is hard to believe but insurers and CBTT have demonstrated their inability to listen to the brokers association and their membership concerning the onerous regulations imposed with the new regulations that are causing more confusion and problems than solutions.

Their points to CBTT are constantly ignored and the fact that the insurance companies have pushed this agenda is disturbing. Anytime a regulation makes it so difficult for companies to comply and are actually causing companies to close down can not be a good thing for the industry.

Insurers have taken advantage of brokers and their agencies for too long in this market and the brokers and agents are upset over this. They are requesting that the CBTT do not enforce more regulations on them that they consider hard to comply with, that they consider unfair and only benefit the insurance companies in the market.

Look at how many agencies are going out of business because of the new regulations implemented by CBTT. The Insurance Brokers Association of Trinidad and Tobago (IBATT) has been speaking to the CBTT for the last four years or so but they feel their voices are falling on deaf ears.

The plan allegedly is that ATTIC and the Central Bank have decided to reduce the number of producers in our market. First strategy of the plan will shrink the amount of competitors out there, clearly affecting the agencies first, evident from what we are seeing by many closures then target the smaller brokers. The mid-sized brokers will have no alternative but to merge or fold up if they want to survive. The plan seems clear to anyone within the industry.

The current government and the Ministry of Finance must take heed of what’s going on here and realise clearly this isn’t good for our economy as all it will do is put more people on the breadline and destroy family businesses that have operated for decades.

The government must relook at this area and see that closure of 16 companies in this short period of time is not a good thing and their focus has to be fostering and encouraging businesses to flourish, committed to strengthening existing relationships with all businesses including the brokers and agencies to ensure greater confidence as regulator and the producers work together to build a stronger, more resilient and sustainable economy.

Neil Gosine is an insurance executive. He is also the treasurer of the UNC and a former chairman of the National Petroleum Marketing Company of Trinidad and Tobago. He holds a Doctorate in Business Administration, a Master’s in Business Administration MBA, BSC in Mathematics and a BA in Administrative Studies. The views and comments expressed in this column are not necessarily those of AZP News, a Division of Complete Image Limited.

![]()