By Prior Beharry

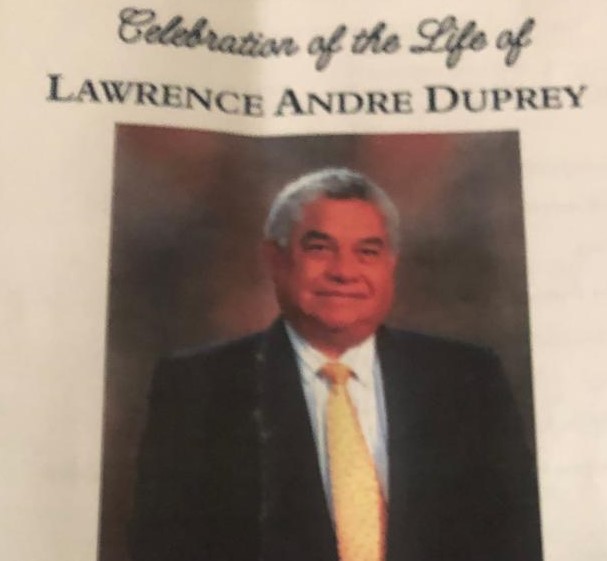

LAWRENCE ANDRE DUPREY has been eulogised as a dreamer of big dreams.

He wanted to create an international mindset for business in Trinidad and Tobago, but was not a good judge of character and one of his biggest mistake was to go on a political platform to speak on behalf of a friend.

The only time that Duprey was said to have cried was when his methanol company was sold to Proman after he went to the government to bail out his financial empire following the financial crisis cause by mortgage rates in the United States.

But, he helped a lot of people get their start in business when other institutions refused to help

This was how he was described by his former employee and friend Ian Artherly.

Duprey’s funeral service took place at the Clary and Battoo Serenity Chapel in Port of Spain on Sunday. He died on August 24, 2024, just a month shy of his 90th birthday that would have been on September 25.

Atherly, a former sales representative and Agency Manager of CLICO, described Duprey as a husband, father, businessman, entrepreneur, philanthropist, motivator and friend.

Duprey leaves to mourn his wife Sylvia Balldini, whom he married in December 1999, and his son Lucien. Durpey also has two elder other sons – Andre and Alexis who reside in Canada. In 1999, he also received the Chaconia Gold national medal for his contribution to business in the country.

Artherly said, “He inherited his uncle’s little insurance company; a company that was built on Cyril Duprey’s maxim which was, ‘If you give a man Value and you give him Service, he will always buy from you.’ He took over the helm in 1987.”

Artherly quipped that that was the same time he became the company’s Rookie of the Year, “so I brought him luck.”

He said Duprey embarked on a mission to catapult the little insurance company into the international arena, becoming an international player and thereby launching T&T into global reckoning outside of the oil and gas for which it was already known.

In the late 1980’s to the early 1990’s, Duprey held the positions of Chairman and Managing Director of CLICO, until Claude Musaib-Ali, a young actuary returned to Trinidad from Canada, and was hired as Managing Director.

Artherly said, “There are three kinds of people in the world of business: those who work all day, those who dream all day, and those who spend an hour or two dreaming before setting out to fulfill those dreams. Lawrence belonged to the third category because he knew there would be virtually no competition. He travelled extensively, chalking up more flying hours than most seasoned pilots. Yet, none of these trips were joyrides.”

He added, “Duprey was always out there talking to the big businessmen getting firsthand knowledge of what they were doing and always with an intent, to see how the new ideas and the systems shaping successful businesses in the developed world, could be modified and adapted to benefit Trinidad.”

Artherly said through a South African connection, Duprey got wind that Barclays Bank wanted to sell its 44% shareholding in Republic Bank in T&T.

Duprey, Artherly said, negotiated the deal at $2 per share at a time when the stock market had the shares trading in the range of $1.10 to $1.20.

When he went to the Central Bank to get its blessings, then governor William Demas told Duprey to negotiate the $2 per share buy price.

Artherly added, “Needless to say, Lawrence had already agreed on $2 and had no intention of renegotiating. And the juiciest part of the entire deal was that he got the same Barclays Bank to lend CLICO the money to buy their shares in Republic Bank.”

He said, “It was around the same time that the senior people around Lawrence persuaded him to relocate from his modest Woodbrook lodgings as it was not in keeping with the requisite image of a successful businessman. So, he was moved to a big house in Fairways which, in their view, was more appropriate and representative of his elevation to business tycoon.

“The old (Mitsubishi) Lancer he drove was soon replaced by a Mercedes Benz and all this fuss left him quite bemused. Lawrence had no airs about him and loved to wear his favourite Hawaiian shirt at every opportunity afforded him.”

Artherly said Duprey had a vision that CLICO/CL Financial and by extension Trinidad & Tobago, should be reflective of international standards.

And his mantra was: “We should only benchmark against international entities!” And out of this, Artherly said came the CLICO Leadership Series.

Artherly said, “CLICO engaged international icons and invited them to visit, interact and address the leaders of T&T and CLICO/CL Financial. The following Icons were part of that initiative: American Civil Rights Activist – Mr Jessie Jackson, former President of the United States – William J. Clinton, former Mayor of New York City – Mr Rudolph Giuliani, former U S Secretary of State – Mr. Colin Powell, former Commissioner of Police – Mr. Bernard Kerik, and Deepak Chopra to name a few.”

He said, “His travels abroad also led to the discovery of leverage and with a 44% block of Republic Bank shares stashed in the CLICO portfolio, he leveraged it to the MAX.

“So he now found himself in a new ballpark, exploring new opportunities, adding tremendous value as far as the leverage would allow.”

Artherly said it was at this point that his team came up with the Blue Ocean Strategy to create uncontested space in a market.

He said, “And I must tell you that having made the blue ocean leap into Methanol production, the betting odds at the tables all around The Union Club was that this investment was going to be the beginning of the end of Duprey and the CL Financial empire.”

Artherly said, “So, you can imagine the relief, the sheer joy, the hallelujahs, that erupted when the plant actually began production, and the price started heading north.”

He added, “The stars were in such alignment, rumour had it that they could have paid back the full cost of the plant after the first year of operation. It was simply phenomenal.”

This success propelled Duprey to the A-list of businessmen.

Artherly added, “Like Elon Musk, Lawrence literally had hundreds of ideas and he went down a few rabbit holes in his quest for ‘the one’ that would make it all worthwhile. So, there was the Dunlop acquisition and the Bata acquisition that didn’t pan out. But the Home Construction acquisition, the Valpark and Long Circular malls all did well. So having started his CL Financial chairmanship in 1994 with assets of $1.7 Billion, 13 years later, by December, 2007, its asset base had grown to $100.66 Billion! That is no mean feat!”

But, then came the subprime mortgage crisis in the US in 2007 and a year later, Artherly noted, “We began to see a drying up of liquidity with large financial institutions desperately trying to shore up their balance sheets with little success.”

Artherly said, “So when back in 2009, the renowned Professor Selwyn Ryan headlined one of his Sunday Express columns in bold capitals: ‘Is Lawrence Duprey our local Madoff?’ The only person to respond to his balderdash was Robert Mayers in the T&T Review. He wrote, ‘Bernie Madoff was a crook! A scam artist! How dare you place Lawrence Duprey in that category?’ ‘Madoff had no assets to show for the billions of dollars he collected! So even if you argue that in some instances, Duprey overpaid for some assets, the fact remains that all of CL’s assets actually exist and can be found.”

He said, “I’m taking the time to go through this because when the crisis landed here, our government and our Central Bank did the exact opposite of what the US authorities did: resulting in a sordid saga that’s still unfolding. And to speak more directly, State Enterprises began to pull their funds from CL subsidiaries by the millions and the Central Bank simply looked on. The rest, as they say, is history, even though it’s still ongoing.

“The only time I’ve ever heard of Lawrence Duprey crying was when he had to sell the shares in Methanol Holdings to Proman. It really hurt. He acquired assets for the long term. He was never a seller. And, yet the time came when he felt compelled to do something that went against the grain of everything he stood for. The record speaks for itself. Remember the $2 price he negotiated with Barclays for their Republic Bank shares?

“That was a 65% premium above the existing market price. Remember the Central Bank Governor telling him he was paying too much for the share? Well, guess what! Thirty-six years later, Republic Bank shares closed at $112 last week Friday; 56 times more than what he paid for them.”

Artherly described Duprey as a political neophyte and one of his mistakes was speaking on a United National Congress (UNC) platform to support his friend and employee Carlos John.

He said, “I’ve come to the conclusion that some people holding very high political office in 2008 – 2009, in collaboration with some private sector operatives, desperately wanted to bring the CL Financial Group to its knees; to teach Lawrence Duprey a lesson.

“And what was his sin? In my view, Lawrence made the cardinal error of publicly appearing and speaking on a UNC Platform in St Joseph in

support of Carlos John back in the early 2000’s. And for that, he has not only paid dearly; he has suffered tremendously – both physically and mentally.”

John was also at the funeral.

Artherly added, “When I think of the sheer quantum of millionaires and multi- millionaires who acquired their wealth either by working for or working with Lawrence, many of whom he called ‘friend’, in retrospect, I can only surmise that he was not a very good judge of character.”

He recalled a letter in the Newsday where Louis Lee Sing admitted that the success of all his business ventures was a direct result of the financial assistance and advice provided by Duprey and Clico Investment Bank when no other financial institution would even give him a hearing.

Artherly said, “This is not an unusual story. Lawrence was simply following in a tradition that was long established by its founder.

“Thousands of people were able to save, to own their homes and attain a decent standard of living thanks to Cyril Duprey and CLICO. Thousands more benefitted when Lawrence took over the helm.”

He said CLICO funded San Juan Jabloteh football club, taking many youths off our streets, Shiv Shakti Dance Group and many other cultural entities.

Artherly said, “All this to say, the roots that CLICO and CL Financial planted in this country and the region run deep. That’s why, even after the Government’s intervention in 2009 and the negative publicity, people were still buying policies from CLICO agents.”

He said, “Lawrence had a vision, not only for the company but for the country! He never stopped being curious; questioning everything.

“He wanted this little speck to be a player on the international stage. And he was making great progress.

“He was getting there! CLICO/CL Financial has withstood the test of time, it has repaid its debt in full, and yet continues to be a profitable entity, isn’t it time it be returned to its rightful owners?

“So, what’s the lesson here? It is simply this: ‘all that we need to completely destroy this country is to put power in the hands of small-minded men and women.’”

The funeral was followed by a private cremation. The service was officiated by Rev Fr Ashley Mungal.

![]()

Kuarlal Rampersad

September 2, 2024So, what’s the lesson here? It is simply this: ‘all that we need to completely destroy this country is to put power in the hands of small-minded men and women.’”